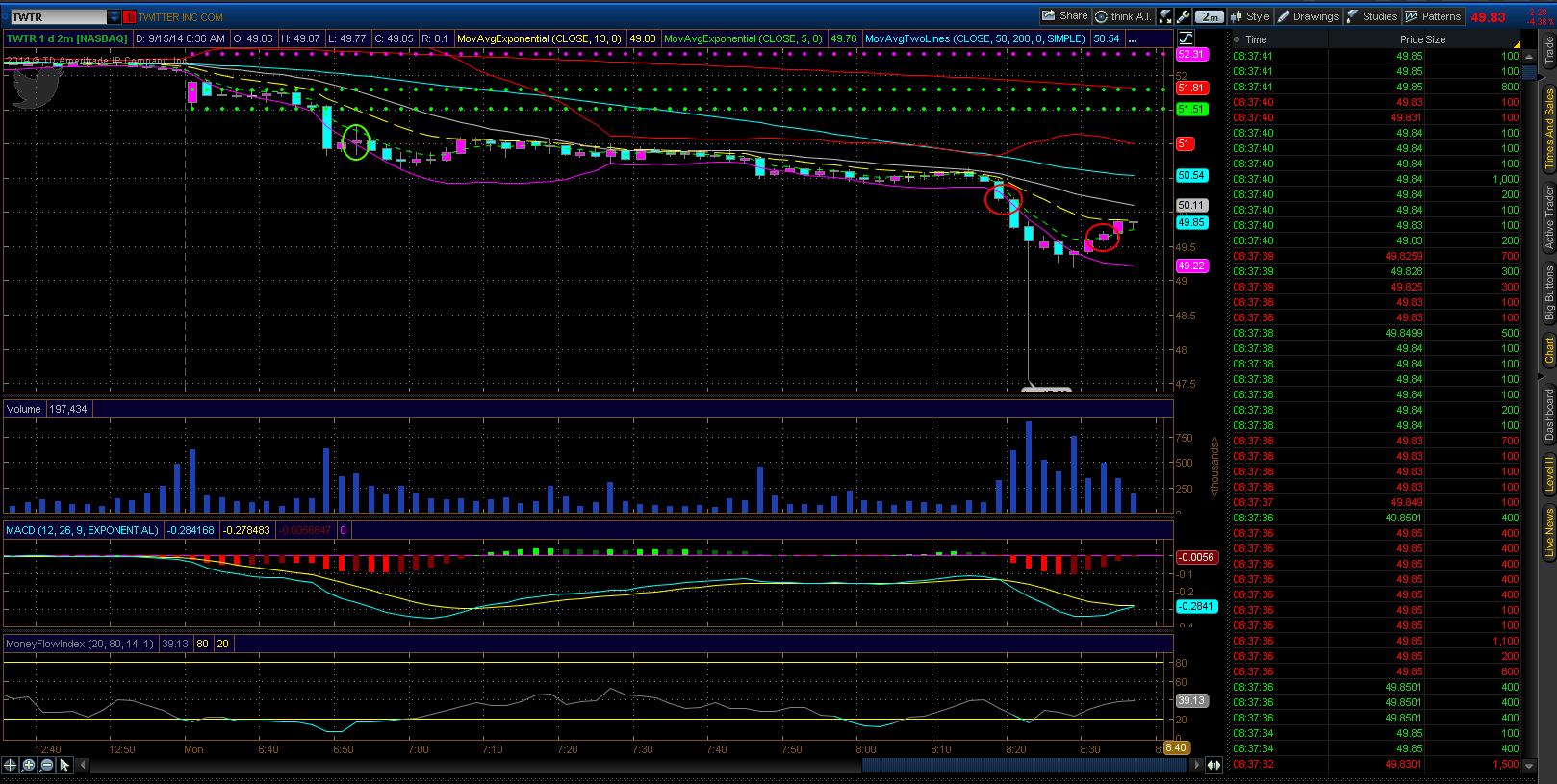

I really do believe I have turned a corner in regards to trading. Today I went through 5 straight losses and only toward the end did I start feeling some emotion (toward Twitter in particular… fucker just wouldn’t budge during lunch). I quickly reminded myself that nobody was out to get me, I took every opportunity that met my criteria and executed without question.

One issue I did notice today is that I missed a real ideal entry and instead of ‘chasing’ just a few cents I waited for the next setup to occur. Had I given myself a little more room for entry it would have easily been a nice winner.

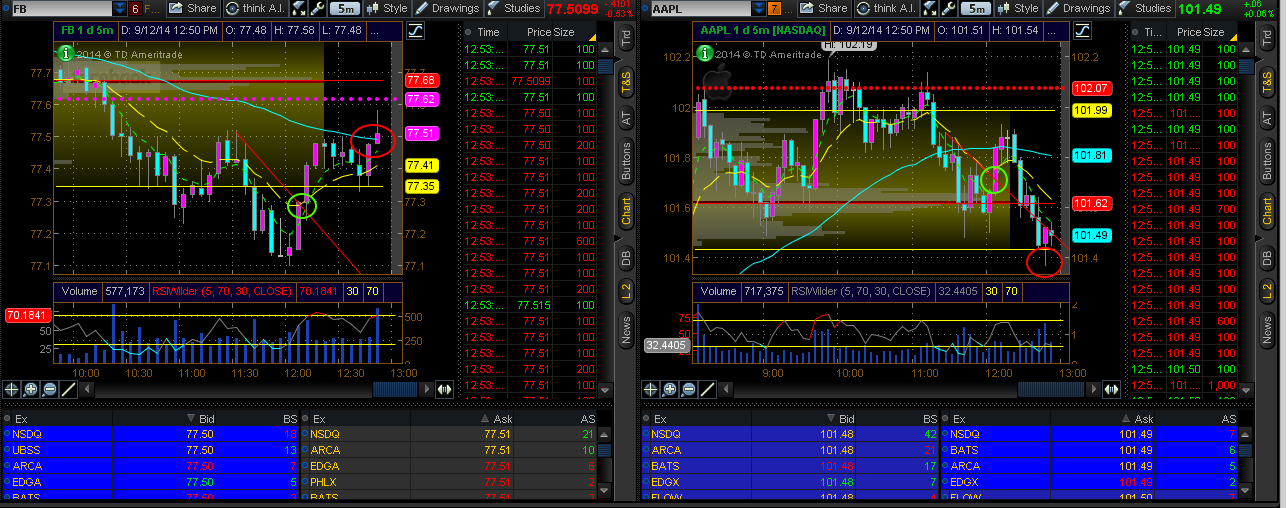

Every trade but 1 worked in the sense that I reached my ‘risk mitigation point.’ That is where I take off 1/3 my position at the amount I use for the stop-loss (but on the positive side). Four of those six losers hit my risk mitigation points and I captured 20c on each contract. What I’m going to do in the future is tighten up my stop loss to 10c at that point so that even if she turns against me, it will be a wash and not a loss.

I had 1 winning trade out of 6 and the best part is, it almost washed away all those other losses. I’m down on the day less than the amount of 1 stop loss for 1 trade. That’s the power of letting your winners ride. With a bit of tuning and experience, I’m going to be just fine. Key is to take it day by day and keep a level head.

Today’s trades were all to the long side (looking for the price to go up). From here on out I’m going to use arrows to show my entry/exit. I’m not going to show all the places I scale out, just where I close the final contract. Green means I entered. Red means I exited.

$TWTR:

$FB: